Customer intelligence that grows revenue.

Twine analyzes every customer conversation, ties it to revenue, and delivers the signals that move roadmaps, deals, and decisions. Automatically.

Twine analyzes every customer conversation, ties it to revenue, and delivers the signals that move roadmaps, deals, and decisions. Automatically.

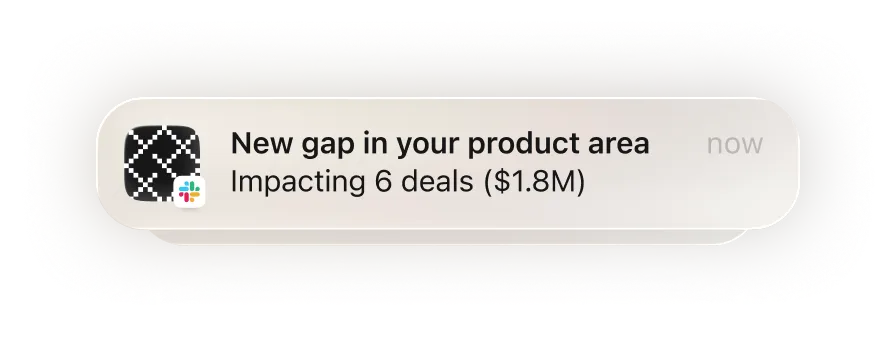

Invisible, until it matters

Twine does the work for you. Delivering what matters, where you work. No tags. No forms. No quarterly note‑taking campaigns.

Built for decisions, not reporting

It connects the dots that actually matter. What’s blocking revenue, where competitors are winning, what customers keep repeating.

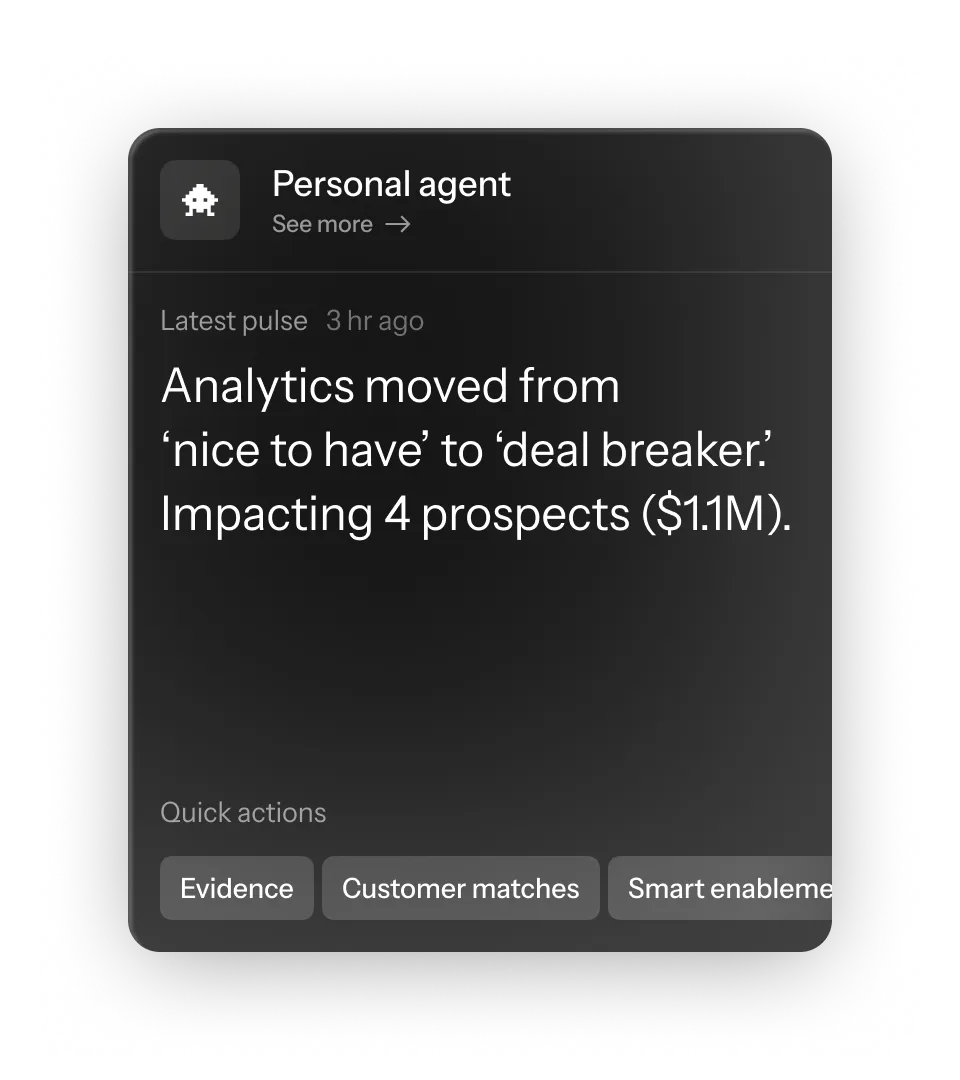

Personalized, proactive

Each teammate gets the blockers, risks, and opportunities that matter to their role—while there’s still time to act.

Chosen by companies who run on clarity, not guesswork

96% of revenue-critical signals never reach the teams who can act.

Twine fixes that.

Connect your call tools

Twine listens, learns, and captures every signal that matters to revenue.

See the patterns shaping your quarter

What’s blocking, what’s rising, and where revenue is at risk.

Know what matters, when it matters

Critical signals reach the right people before risks turn into losses and opportunities slip by.

Like having an analyst in every call.

Only faster. And effortless.

Twine hears every word, finds the patterns, and surfaces what moves revenue.

All of it

delivered before issues become losses.

Delivering the kind of work you wish your team had the bandwidth for.

Baseline agent

The radar every

company runs on

Focus agents

What matters to

your team

Personal agent

Intelligence cut to you,

not the crowd

The blockers that cost you the most are the ones you spot late.